Economics & Finance

• 6 minute read

Securities Token Offerings: The Next Big Thing?

CUHK expert shares insights on whether Securities Token Offerings will be the next trend in cryptocurrency community

By Mabel Sieh, Managing Editor, China Business Knowledge @ CUHK

After the collapse of bitcoin prices in 2018, the crypto world has quickly adapted and turned to securities token offerings (STOs) from initial coin offerings (ICOs). The reason lies in the differences between the two digital offering, according to Chew Seen-meng, Associate Professor of Practice in Finance from the Department of Finance at The Chinese University of Hong Kong (CUHK) Business School.

“In ICOs, investors are offered ‘utility tokens’. While these ‘utility tokens’ don’t represent any equity interest on the coin issuer, they can be used to exchange for products or services offered by the underlying company,” says Prof. Chew who serves as an Honorary Research Advisor for FinFabrik, a Hong Kong-based financial technology solutions provider that specializes in capital markets.

“In STOs, on the other hand, investors receive ‘security tokens’ similar to stocks or shares in a way that they represent the equity stake of the underlying company and offer investors voting rights and dividends – features that are absent in ICOs. These ‘security tokens’ make use of blockchain technology to digitally record investors’ ownership of assets (e.g., gold or real estate) or economic rights (e.g., a share of profits or revenue),” he adds.

How do security tokens differ from the traditional shares offered in an IPO, as shares are already represented digitally and traded electronically?

“The key difference lies in the fungibility of digital tokens,” says Prof. Chew.

“With traditional shares, one would have to first sell company A’s shares for cash, then use the cash to purchase company B’s shares. In the case of security tokens, there is no need to involve flat currencies, since tokens from company A can be used directly to exchange tokens from company B. This has allowed investors to trade in a more direct and effective manner,” he says.

STO Regulations

These securities-like features of tokens offered via STOs are subject to regulations laid out by the Securities Exchange Commission (SEC) in the United States. Specifically, according to the Securities Act of 1933, only accredited investors can participate in them, as Prof. Chew explains.

“In Singapore, the Monetary Authority of Singapore (MAS) issued “A Guide to Digital Token Offerings” in November 2018 to urge token issuers to comply with MAS regulations if the tokens are classified as securities,” he says.

As for Hong Kong, the Securities and Futures Commission (SFC) issued a statement in March 2019, highlighting that tokens issued in STOs are likely to be securities, and thus subject to the securities laws of Hong Kong. “The statement also outlines some warnings of the potential risks involved in virtual assets,” he adds.

Prof. Chew believes that all these regulations towards digital tokens are good for the market and investors.

“This is a positive development because the regulatory shield covering STOs will make them safer for investors, as issuing firms will need to pass several due diligence requirements set by regulators before launching their offerings,” says Prof. Chew. “In addition, the regulation will ensure that STOs are offered to accredited investors who have higher capacity for taking investment risks – unlike ICOs which can be marketed to almost anyone.”

A clear regulatory guidance will also lay the groundwork for securities advisory firms to provide underwriting services to companies that intend to raise funds through STOs.

“In time, this could help expand the use of STOs as a fundraising mechanism, develop tokens as a new asset class and increase the user adoption of digital tokens,” says Prof. Chew.

Implication to Startups

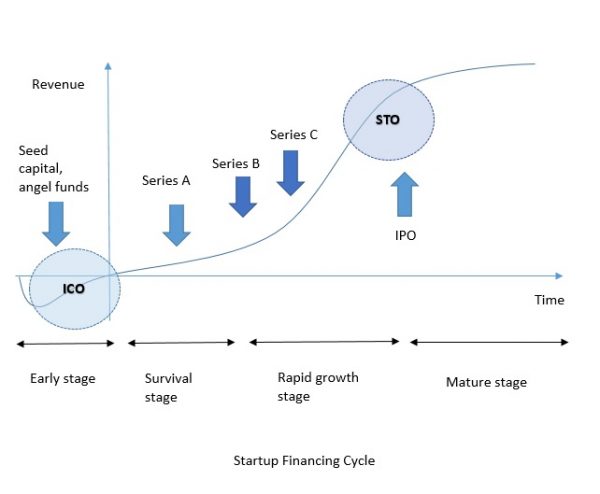

According to Prof. Chew, in order to satisfy regulatory requirements, it is likely that startup companies would only raise funds through STOs at a more mature stage – when their products are proven to be commercially viable and have begun to generate stable streams of revenues.

“ICOs are similar to angel funding in that they are typically issued at the early stage of a startup facing a higher chance of failure. STOs, on the other hand, will come in at a much later stage – probably around the same time when the company is ready to launch an IPO (in the traditional market). Thus, STOs should theoretically have a lower probability of failure, and less likely to cause investment losses, as compared to ICOs.”

65

65

Currently, the total cost of a single IPO issuance in Hong Kong is above HK$25 million, and the entire process typically takes six to nine months to complete.

“While it is not immediately clear that the cost and duration of STO is much lower (due to a lack of reference examples and case studies), the automation of some mundane due diligence and know-your-client (KYC) steps through smart contracts should theoretically help to make it more efficient. Moreover, the digital record of transaction details on the blockchain system could facilitate transparent monitoring of the security tokens in the future,” he says.

“We need more success stories of STOs launch with investors receiving dividends and making good returns in their investments. These precedents will encourage more firms to raise funds through STOs, more people to invest in them, and more trading of the tokens, thus creating a virtuous cycle.” – Prof. Chew Seen-meng

Future of STOs

In 2018, the total amount raised through STOs was around US$ 380 million and the amount continues to increase. “An example of STO is tZero issued by Overstock, which raised US$ 134 million. Overstock is the first major online retailer in the U.S. accepting bitcoin as payment for its goods,” says Prof. Chew who believes these numbers are still small compared to some major IPOs where the amounts raised are easily in the billions. “It is still early to say whether this new type of digital fundraising market can fully take off in the coming years,” he says.

Whether STOs will be the ‘next big thing’ remains unknown but Prof. Chew believes their future adoption depends on two key issues.

The first issue concerns valuation and pricing. “How should traditional financial models be used or adapted to price tokens issued in an STO? This is an easier problem to manage if fiat currencies are used to acquire tokens. However, if cryptocurrencies are used instead, the pricing of tokens becomes tricky since the values of cryptocurrencies are very volatile and arbitrary,” says Prof. Chew.

The second issue pertains to the liquidity of tokens, which is still low.

“Until tokens become widely adopted and a sizeable market is developed for them, the trading and hence the liquidity of tokens will be highly limited. Without a critical mass, it is hard for security tokens to be recognized as a credible asset class,” he says.

“We need more success stories of STOs launch with investors receiving dividends and making good returns in their investments,” says Prof. Chew. “These precedents will encourage more firms to raise funds through STOs, more people to invest in them, and more trading of the tokens, thus creating a virtuous cycle.”

Like any type of investments, investors of STOs are exposed to risks, Prof. Chew warns potential investors.

“There is no guarantee that STOs will generate higher returns than IPOs. It is the responsibility of the investors to conduct proper due diligence and to fully understand the issuer’s business and industry before they invest in anything,” he says.