What is Inflation?

The term Inflation is used to denote an ongoing rise in the general level of price quoted in units of money. The magnitude of inflation is the inflation rate, which is usually calculated by measuring the annualized changes in the price level of a basket of goods and services — Consumer Price Index (CPI).

With inflation occurring, the same amount of money could only purchase less amount of goods and services compared to the base year, which lead to the decline in purchasing power.

Consumer Price Index – Measure of Inflation

The year-on-year rate of change in the CPI is widely used as an indicator of inflation. The CPI measures the changes over time in the price level of consumer commodities and services generally purchased by households.

According to C&SD, The CPI in a specific month is computed by comparing the total expenditure required to purchase a basket of consumption items in that month with that required to purchase the same basket in the base period.

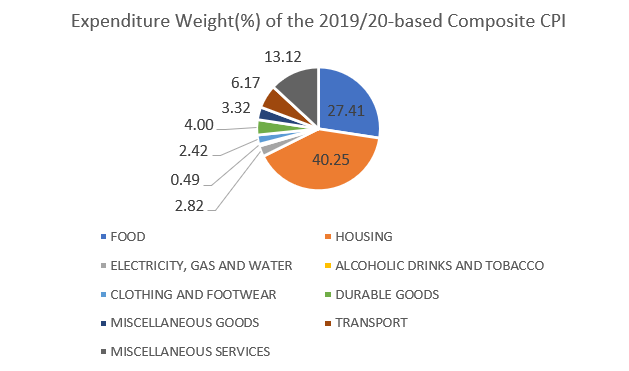

All of the changes in the price of goods or services in the basket for compiling the CPIs are weighted according to the Household Expenditure Survey (HES) conducted by C&SD supplemented by data from other sources. Figure 1 shows the weights of different items of the 2019/20-based composite CPI.

Figure 1: Expenditure Weight of the 2019/20-based Composite CPI

The price index in the base period is set to be 100. If the index increases to be 103 next year, it means we need to pay $103 today to purchase the same basket of goods and services that cost $100 a year ago.

As the CPI basket is not identical with the specific basket of goods and services every citizen consumes, so that it only represents a rough approximation of the changes in our cost of living.

Depending on the income level and consumer preference, the expenditure patterns of households vary. The C&SD have compiled three series of CPIs, each referring to households in a different expenditure range.

Hong Kong inflation rate movement from 1984 to 2021

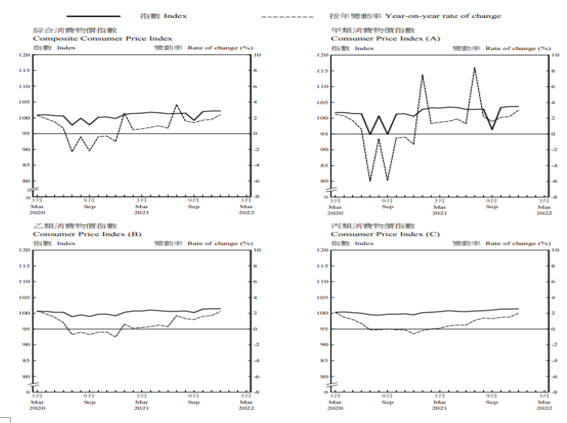

The inflation rates of all kinds have picked up the increasing trend since the fourth quarter of 2020. (See Figure 1). In December 2021, the composite CPI, CPI(A), CPI(B), CPI(C) all registered year-on-year rates of increase, at 2.4%, 3.0%, 2.2% and 2.0% respectively.

Figure 2: Consumer Price Indices at all-item level (Oct.2019 – Sep.2020=100)

If we look at the past few decades, from 1984 to 2000, the annual inflation rate was dropping drastically from 15% to -5%, much more fluctuated compared to that in 2000-2021 that averaged at around 3%. (See Figure 3)

Figure 3: Hong Kong inflation rate in 1984-2021

Sources: Tradingeconomics.com

Cautionary Remarks of CPI

With the changes in prices of items, the income of individuals and other socio-economic factors, the consumption patterns of households are to change gradually over time. The expenditure weights of each item in the basket should then be adjusted accordingly, otherwise, the changes of CPI may fail to reflect price movement over time.

According to C&SD, households tend to buy more of the goods and services with smaller price increases to substitute those with larger price increases. Due to the substitution effect, the CPI compiled based on fixed consumption patterns tends to overstate price increases over time.

Concerning the bias mentioned above, the expenditure weights will be updated once every 5 years in Hong Kong.

Reference: