CUHK has been recognized as a prescribed foreign university in Canada under Section 3503 of the Canadian Income Tax Regulations and was added according to Schedule VIII of the Regulations by Order-in-Council P.C. 2010-551. With an official receipt issued by CUHK, Canadian donations can be claimed against the taxable income according to subparagraph 110.1(1)(a)(vi) and paragraph 118.1(1)(f) of the Canadian Income Tax Act.

Step 1

Please download the donation form from the following link:

https://www.oia.cuhk.edu.hk/f/upload/830/canada-donation-form.pdf

Step 2

In "Donor Particulars" section, please indicate your Canadian mailing address for tax-deductible receipt applicable in Canada.

Step 3

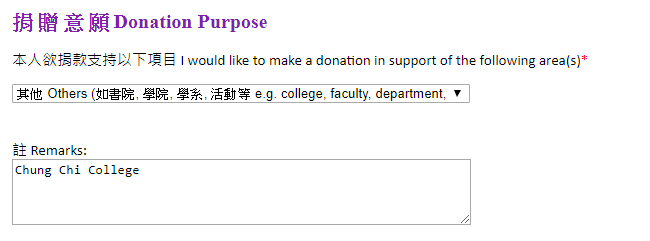

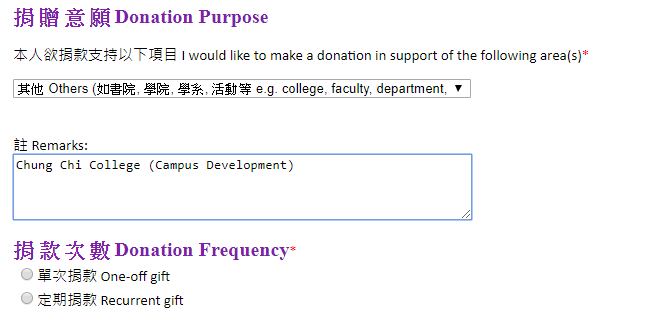

In "Donation Amount" section, please check the box "Other Programmes" and then enter "Chung Chi College" and specify one of the following projects in the space provided:

a) Chung Chi Student Development Complex

b) Campus Development

c) Student Development OR

d) Other Projects (Please specify)

Step 4

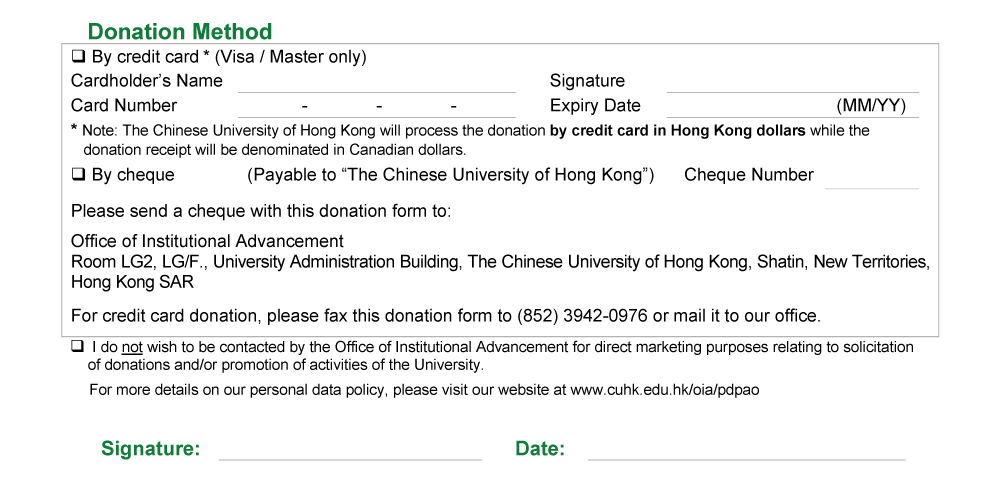

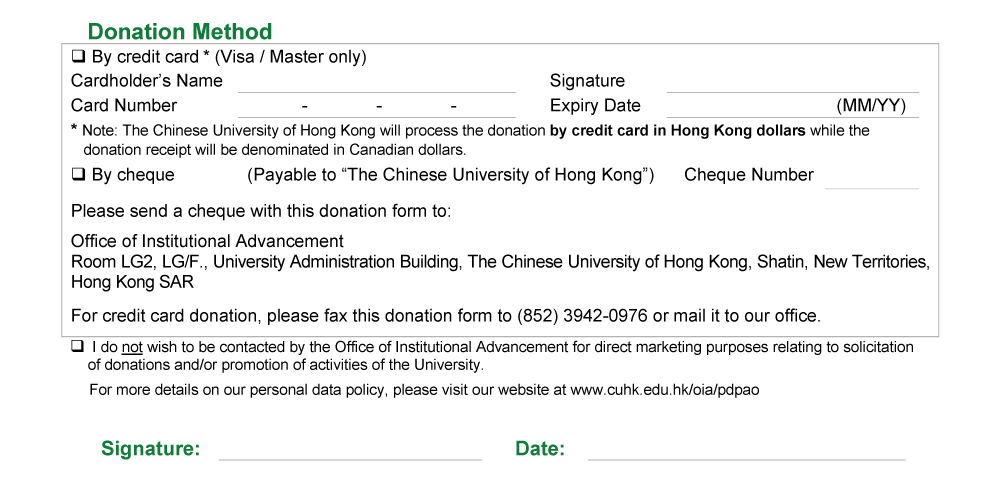

In "Donation Method" section, please choose either credit card or cheque. Please then sign the form and write the date.

Step 5a

Please send the cheque with the donation form to the following address:

Chung Chi College Development Office

1/F, Chung Chi College Administration Building

The Chinese University of Hong Kong

Shatin, New Territories

Hong Kong SAR

Step 5b

For credit card donation, please fax the donation form to (852) 2603 6210 or mail it to the above address.

Enquiries

Enquiries regarding donation through this channel can be made to:

Chung Chi College Development Office:

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

Phone: (852) 3943 6498

Fax: (852) 2603 6210 1/F, Chung Chi College Administration Building, Chung Chi College, The Chinese University of Hong Kong, Shatin, New Territories